Hierarchy of MARKETS - T&M

PICTURES( are better than thousand words)

All of the World’s Money and Markets in One Visualization

Commodity Trading: Backbone of the global economy

GLOBAL WEALTH BY population and REGIONS 2019

- see inside - june 2022 [An Investor’s Guide to Crypto](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=

GDPs https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)

- similar to revenue

GDP Ranked by Country 2020 Total World GDP: 91.98 Tn

USA 21.5 Tn

China 15 Tn

Russia 1.7 Tn

- by income?

Global Real Estate is about the same as Global Debt, which is 217 T

Distortions II: “To grasp the differentiation, consider the most glaring QE distortion – negative yielding debt,” continued Lindsay. “At peak, there was usd18.4trln negative yielding debt in public markets. For context, in Q1/2008 the total of the entire residential US mortgage market was usd14.7trln, from 2004-2007 there were 1.4trln CDOs issued, and the size of Lehman Brothers’ balance sheet was 640bln at the peak,” she said. “There is still usd2.5trln in negative yielding debt, and we’ve just experienced the worst first quarter for bond returns in history.”

Distortions III: “At the end of Q1 2022, global central bank balance sheets had shrunk slightly to just under usd31trln,” said Lindsay, keeping close tabs. “This usd31trln is made up of securities bought at uneconomic prices with the goal of smoothing activity and encouraging investment. It ended up just distorting financial market prices,” she said. “EU GDP is usd15trln, global GDP is usd84trln. To return balance sheets to where they were in 2010 at the beginning of QE would mean a sale of usd20trln in assets, or roughly equivalent to selling the entire usd24trln in US annual GDP.”

by Equity

Global Equity is 77T

USA public equity market

russian equity market is 1% of Global Equity?

cryptocoins

monetary mass in USD, EUR, etc.

VC size

Bonds

International and domestic bond markets

Interesting case of South Korea - large bond markets relative to GDP https://www.worldometers.info/gdp/gdp-by-country/

- bonds Global Debt is 222 T

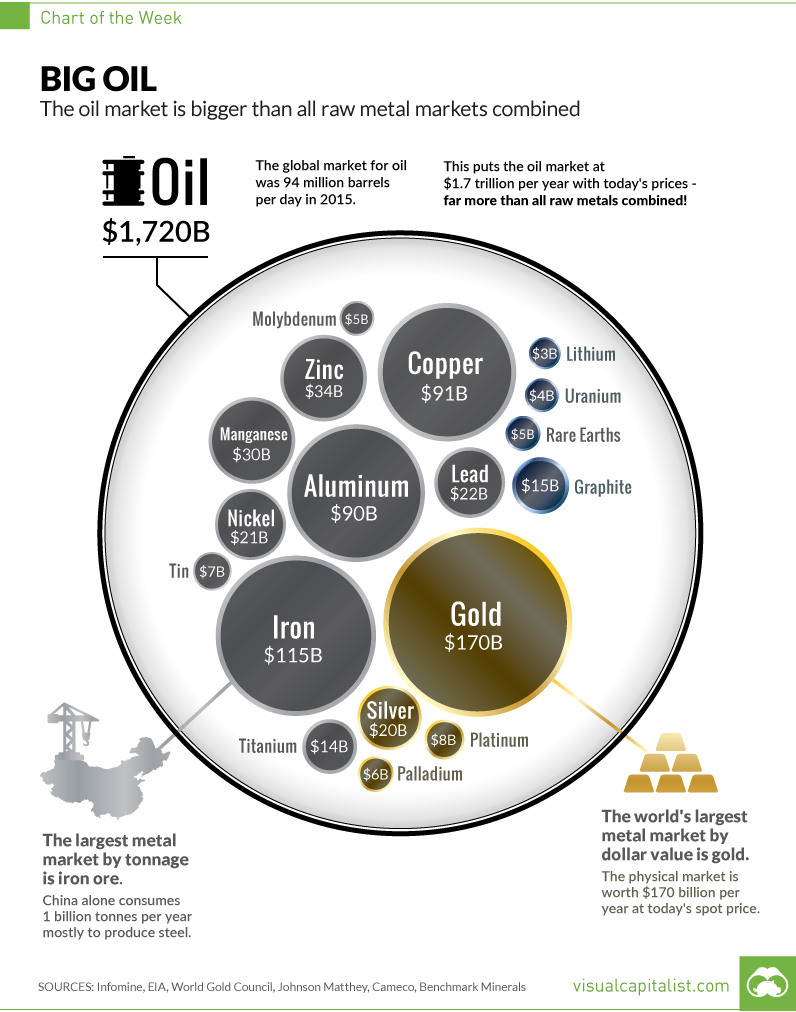

Commodities

https://medium.com/@comdexofficial/commodity-trading-backbone-of-the-global-economy-131c78f12989