Retail Traders

- july-august 2020

- june 2020

Robinhood Traders Step Into Void Left by Dearth of Buybacks

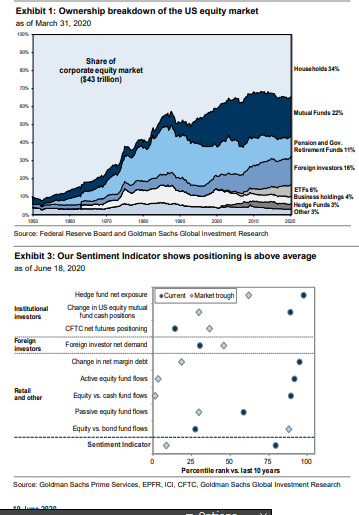

“Foreign investors and households will supplant corporations as the largest 2020 source of U.S. equity demand

GS - Foreign investors and households will supplant corporations as largest 2020 source of US equity demand

Households (which includes hedge funds) bought just 7 billion of US stocks during 1Q.

Zerohedge - bearish angry bias - june 6, 2020 Goldman's Clients Are Getting Angry That Teenage Daytraders Are Crushing Them

My not-so-profound thoughts about valuation, corporate finance and the news of the day! http://aswathdamodaran.blogspot.com/

The Math of Value and Growth Michael J. Mauboussin michael.mauboussin@morganstanley.com Dan Callahan, CFA

Growth, Return on Capital, and the Discount Rate

Thus, the trading of institutional investors magnifies the trading of individuals

april-may 2020 equities rally and Dave Portnoy phenomenon

- my Twitter discussion

Yes. Not just Citadel. But they are the one that handles 80perc of retail orders and one of the few biggest players in the s&p mini. They are notorious for manipulating around the global markets for institutional investors.

Citadel->Programs/Algos->TD/Etrade/Robinhood. In that order

Avg acc value of RH: 1k to 5K

of Etrade: 70k

of Morgan Stanley: 900k

Traditional online brokerage avg acc value is significantly higher than RH. RH has more users, but others are close. In RH: can’t trade bonds, futures, future options which trading volume is larger than equities

Wall Street Fixates on a College Side Project Tracking Robinhood

Daily visitors to Robintrack.net has grown 13-fold to 50,000

Website tracks Robinhood users’ stock holdings in real time